Many industries have regulations and statutes to ensure consumer protections exist when it comes to financial matters. After reading this blog post, you will be able to choose a professional wisely. Getting your taxes filed every year is just another part of adulting. Knowing if you’re getting the best type of service for your finances can be challenge when it comes time to file your taxes each year.

It’s hard to tell what you’re really paying for. Having information to compare services before you file and pay taxes is of upmost importance for your financial well-being. Only a few states regulate their tax preparers. These states are California, Illinois, Nevada, Connecticut, Maryland, New York and Oregon.

Non-credentialed tax preparers are people who prepare tax returns but are not Certified Public Accountants or Enrolled Agents.

There are about half a million people who work as non-credentialed tax preparers. All paid preparers and some volunteers are required to sign tax returns using a Preparer Tax Identification Number (PTIN). Most of them work with national tax preparation services like H&R Block, Liberty Tax Service, or Jackson Hewitt Tax Services.

Non-Credentialed tax preparers typically handle individual tax returns, which are less complicated than those for businesses. They generally get paid less than Certified Public Accountants and Enrolled Agents. Unlike tax preparers, we are tax professionals. We handle a variety of tax matters not limited to tax preparation such as tax planning, tax controversy, and advisory.

The Internal Revenue Service and the practitioner community are working hard to require minimum standards to become a paid tax return preparer. The Internal Revenue Service can only do so much to protect taxpayers from financial harm by unethical return preparers. Taxpayers like you have a role to play in protecting your financial information.

Because most paid preparers do not have professional designations and may be unregulated, be sure to choose a tax preparer wisely. You are responsible for all of the information on your income tax returns.

Did you pay someone to do your taxes?

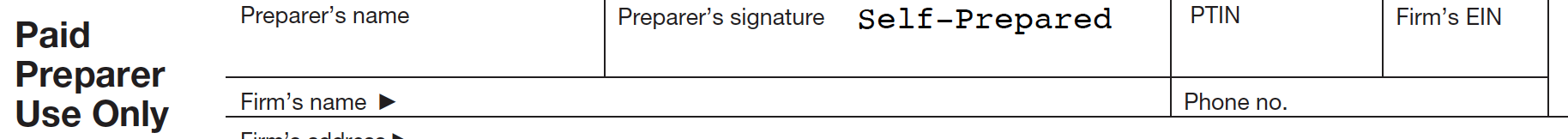

Does the signature box look like this photo?

Paid Preparer Only Signature Box Signed “Self-Prepared”

Paid Preparer Only Signature Box Signed “Self-Prepared”

You may have given your financial information to an unregulated tax preparer. Most importantly, make sure your tax professional signs your return using their PTIN. Ascension Financial Services signs every tax return that goes out of our offices.

Do you need to file a tax return? Click here to see our rates. If you’re ready to file or would like to ask us any questions, schedule a consult.

Where to Find a Tax Preparer

- Use the Internal Revenue Service Directory

- Start with your local state tax agency or State Board of Accountancy’s CPA search

- Use the Find a Tax Expert feature on the National Association of Enrolled Agents website

- Use the Find a preparer tool on the National Association of Tax Professionals website

Here are some tips you should remember when selecting a tax preparer:

- Check the preparer’s qualifications

- Ask them what they do in case of an audit or IRS Notice

- Ask about fees

- Ask to E-file

- Ask about year-round services

- Provide records and receipts

- Never sign a blank return

- Review before signing

- Ensure the preparer signs and includes their Preparer Tax Identification Number

- Report Abusive Tax Preparers to the IRS or let us know